AI adoption in the UK financial services industry has shifted from futuristic buzzword to a day-to-day reality, and the momentum is unmistakable. Imagine a sector where algorithms handle customer queries in seconds, bank loans are processed in minutes, fraud is intercepted before it even hits accounts, and insurers settle claims almost instantly. That’s what’s happening in 2025 – and it’s just the beginning.

Banks and Insurers: The AI Revolution Has Landed

According to new surveys, three-quarters of UK financial firms are already using AI – with almost every major bank, insurer, and asset manager ramping up investment this year. Lloyds Banking Group, for instance, now runs over 800 AI models, powering more than 200 use cases from smarter payment flows to ultra-fast customer service (attribution: Lloyds Banking Group – Press Release). Aviva and other insurers deploy AI in risk modelling, underwriting, and claims, cutting cost and improving outcomes for policyholders (attribution: KPMG – Advancing AI Across Insurance).

Productivity and Beyond: Tangible Gains

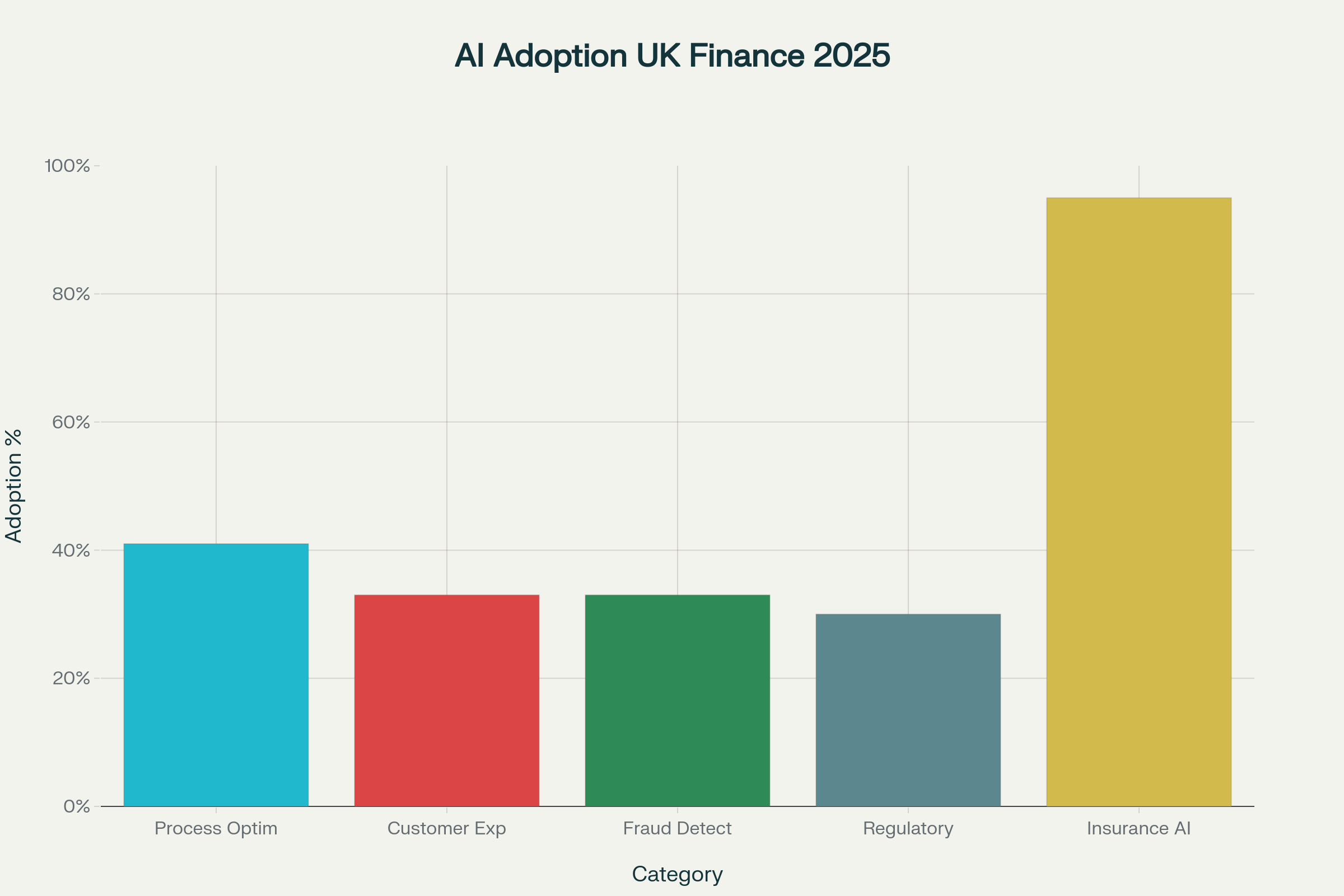

The numbers are staggering – almost 60% of institutions now report a dramatic productivity boost thanks to AI, nearly double last year’s figures. Customer experience is taking off too, with a third of firms using chatbots, sentiment analysis, and tailored advice to engage clients in new ways. Even finance departments are jumping on board, automating repetitive tasks and supercharging forecasting accuracy. In short, time-consuming paperwork and manual error are giving way to streamlined digital processes.

Combatting Fraud and Staying Secure

AI isn’t just making things faster – it’s making them safer. UK businesses now rely on machine learning for fraud detection, analysing millions of transactions in real-time and catching suspicious activity before consumers or regulators spot it (attribution: Keyrus – AI and Fraud Prevention in UK Finance). Cybersecurity remains a top concern, but with dedicated AI teams and partnerships, companies are staying ahead of ever-evolving threats.

Regulatory Challenges and Skills Shortages

Of course, it’s not all smooth sailing. The rapid rise of AI has regulators moving quickly to keep pace, testing new rules to ensure algorithms don’t threaten fairness or stability. Meanwhile, UK firms face a talent crunch: 81% report not having enough specialist staff to fully unlock AI’s potential (attribution: Financial Services Skills Commission – Artificial Intelligence Report). The government and industry are working together to build skills, accelerate innovation, and keep the UK a global leader.

The Road Ahead

Half of UK financial institutions plan to keep raising their AI spend next year, with many seeing the technology as key to driving growth, saving costs, and gaining a competitive edge. As sentiment swings sharply in favour of AI (now seen as opportunity by over 90% of leaders), the next wave of digital innovation is already underway.

In the world of UK financial services, AI isn’t just the future. It’s the engine powering how business gets done – today.

If you’re watching for what’s next, you’re not alone. With new use cases appearing every month, and rising optimism across the sector, 2025 could be the year AI truly transforms UK finance for good.

So where does Optimizely come in?

Optimizely Opal stands out as a transformative solution for financial services teams eager to harness AI for real business impact. Powered by cutting-edge AI agents tailored specifically for marketing and customer engagement, Opal enables organisations to automate everything from campaign strategy to personalised communication, all while maintaining clear alignment with brand standards and compliance needs. Its deep integration with analytics and experimentation tools means financial firms can move from insight to action faster, scaling up digital experiences and testing new ideas without bottlenecks or manual handoffs. With secure data handling, customisable workflows, and agent orchestration, Optimizely Opal helps financial institutions achieve the scale, agility, and confidence needed to thrive in today’s AI-driven market (attribution: Optimizely Opal AI agents and features).

Leave a Reply